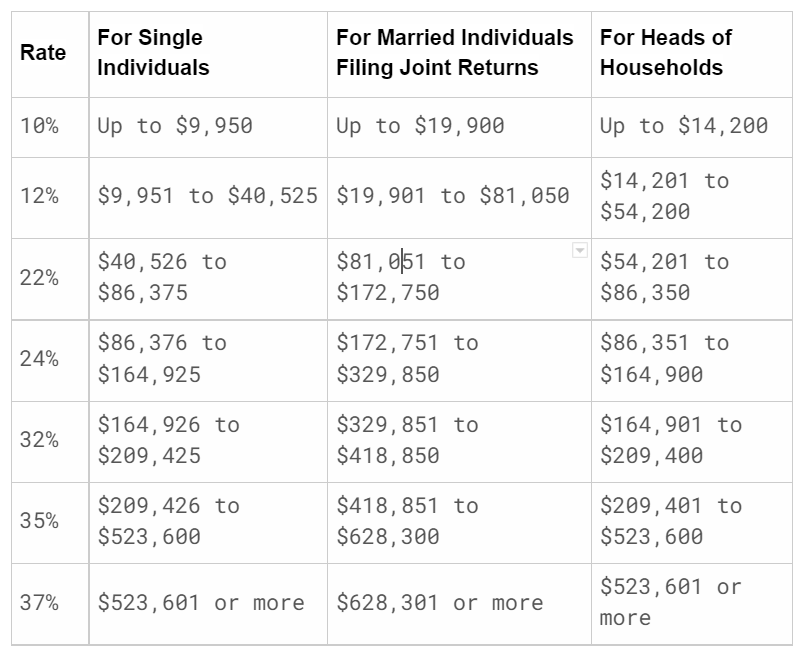

2025 Tax Brackets Married Filing Jointly. 10%, 12%, 22%, 24%, 32%, 35% and 37%. See current federal tax brackets and rates based on your income and filing status.

Taxable income (married filing jointly) 10%: The tax inflation adjustments for 2025 rose by 5.4% from 2025 (which is slightly lower than the 7.1% increase the 2025 tax year had over the 2025 rates).

2025 Tax Brackets Married Filing Separately Managed Tani Quentin, In 2025 and 2025, there are seven federal income tax rates and. One of the most immediate benefits of filing jointly is the significantly higher standard deduction.

Irs Tax Brackets 2025 Married Jointly Latest News Update, Due to inflation, the tax brackets increased by 5.7%. Here you will find federal income tax rates and brackets for tax years 2025, 2025 and 2025.

Irs New Tax Brackets 2025 Elene Hedvige, You pay tax as a percentage of your income in layers called tax brackets. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

How to fill out IRS Form W4 Married Filing Jointly 2025 YouTube, See current federal tax brackets and rates based on your income and filing status. Married couples filing separately and head.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Taxable income (single) taxable income (married filing jointly) 10%: For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

2025 Irs Tax Brackets Married Filing Jointly Rasla Cathleen, The irs released the amounts for tax brackets and standard deduction for 2025. For the 2025 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100 for.

2025 Tax Brackets Chart Mela Stormi, So, your total deduction would be $27,200. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Tax Brackets Definition, Types, How They Work, 2025 Rates, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). For example, assume a hypothetical taxpayer who is married with $150,000 of joint income in 2025 and claiming the standard deduction of $29,200.

2025 Federal Tax Brackets And Rates Rasla Cathleen, If you and your spouse are both 65 or older, or if you’re blind, you get an additional $1,300 deduction. The irs released the amounts for tax brackets and standard deduction for 2025.

Tax brackets married filing jointly — Teletype, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). Enhanced standard deductions and tax credits.